Narcissists with Money: Learn The Toxic Money Habits

Narcissism and money often go hand-in-hand. Research shows that narcissists, or people who exhibit extreme self-involvement, a need for admiration, and a lack of empathy, frequently display problematic financial habits and attitudes.

These money-related behaviors serve as tools for manipulation, status-seeking, and control over others. Understanding the connection between narcissistic personality traits and toxic spending tendencies provides insight for managing relationships impacted by this destructive dynamic.

This article will examine the money mindsets and harmful financial patterns commonly observed among narcissists with money. We’ll explore relevant research linking narcissism and entrepreneurship, and unpack manipulative tactics like secrecy around finances and stinginess behind closed doors.

Most importantly, readers will gain strategies for protecting themselves – setting boundaries, increasing transparency, and maintaining independence.

Arm yourself with education on the narcissist’s twisted financial logic. Recognize signs of inequitable or reckless spending through documentation.

Seek external support in managing the turbulence of double standards and financial punishment. Increase your awareness around common controlling tactics like gaslighting over money matters or presenting a misleading image of wealth.

Manage the rocky waters of narcissistic money habits with calm, consistent boundaries. Prioritize genuine intimacy over lavish gifts given strategically. Pursue financial fairness even when it displeases the narcissist’s insatiable ego.

With knowledge, emotional resilience, and external support, it is possible to mitigate the money turmoil caused by narcissistic partners, friends, or family members. Protect your financial future by recognizing manipulation early on.

The journey to financial freedom requires disentangling from narcissistic money habits. It begins with insight, courage, and refusing to accept financial behaviors that feel innately destructive. This article provides a roadmap.

Subscribe to Create Higher Vibrations!

Get Inspiration and Practical advice straight to your inbox.

Narcissism and Entrepreneurship

Many narcissists are drawn to entrepreneurship, as building one’s own business can feed grandiose fantasies of unlimited success. Research finds that narcissism is more prevalent among entrepreneurs compared to the general population. One study revealed that entrepreneurs scored higher in narcissism than managers across several countries and cultures.

The visionary nature of entrepreneurship appeals to the narcissist’s appetite for recognition. Starting a company places them in a position to gain status, validation, and authority over others. However, several narcissistic traits pose threats to responsible financial management and leadership.

Narcissists struggle to build strong teams due to a lack of empathy, often alienating those closest to them. Their tendency to manipulate and exploit people can undermine ethical business practices. Excessive risk-taking without consideration of consequences can lead to financial disaster.

Furthermore, narcissists feel entitled to special privileges, lavish expenditures, and public admiration. A study found narcissism to be associated with addictive shopping habits among entrepreneurs, regardless of business income.

Another investigation revealed that narcissistic CEOs favor bold, flashy strategies aimed at garnering attention rather than steady results.

Thus while vision, charisma, and willingness to take risks contribute to entrepreneurial success, unchecked narcissistic motives can be the enterprise’s demise.

The narcissist may profit temporarily from risky ventures, duplicitous business partnerships, or gambling investments. However, financial ruin, lawsuits, and destroyed credibility often follow in the wake of the narcissist’s insatiable quest for glory.

In entrepreneurship as in other domains, recognizing narcissistic patterns provides growth opportunities. Seeking accountability through financial transparency and high-quality advisors can mitigate destructive behaviors.

Focusing on intrinsic rewards nurtures authentic self-esteem beyond fame or wealth. For the non-narcissists in business with people exhibiting manipulative financial conduct, safeguard yourself through documentation, firm boundaries, and examination of the relationship’s costs versus rewards.

With awareness and diligence, entrepreneurs can channel motivation toward ethical and sustainable profitability.

Top 5 Toxic Money Habits of Narcissists

Narcissists display predictable patterns of harmful financial conduct. Recognizing these toxic money habits is the first step toward protecting oneself from additional financial and emotional damage within the relationship.

1. Secrecy Around Finances

Narcissists tend to be vague and secretive about their financial situation and plans. They may open credit cards or accounts without informing their partner, making unilateral decisions regarding major purchases or investments.

This financial infidelity erodes trust and prevents realistic evaluation of budgets and spending habits. The narcissist maintains an aura of mystery to control their partner’s perception of what they can afford.

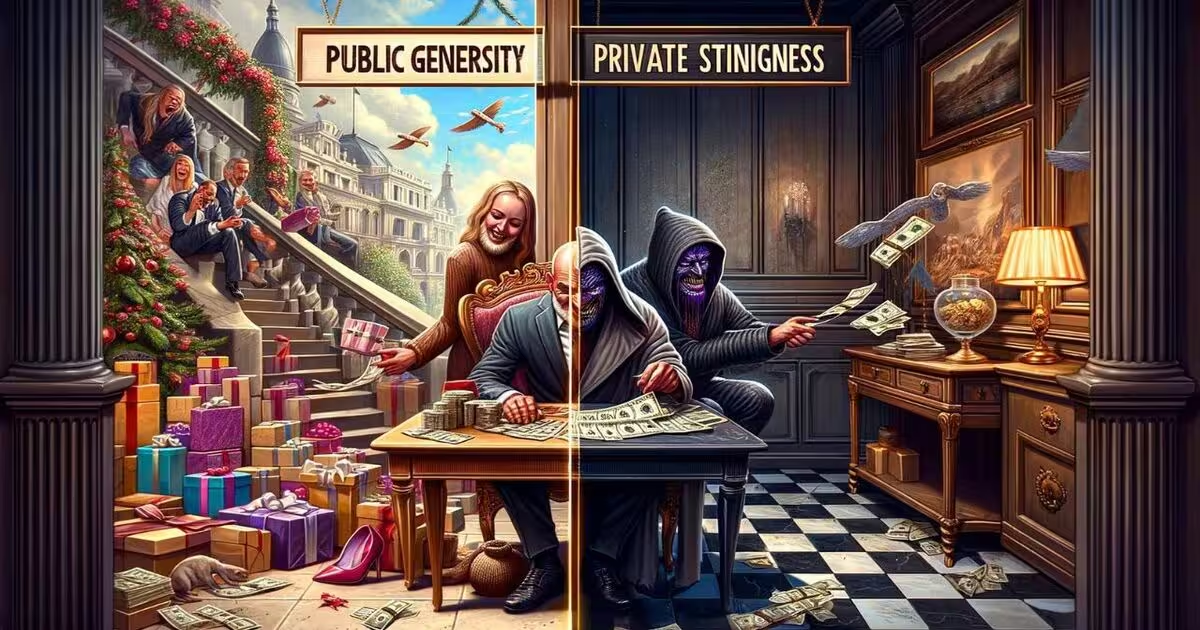

2. Public Generosity, Private Stinginess

The narcissist may shower their partner with expensive gifts and luxurious dates at the beginning of a relationship. They portray themselves as incredibly generous, and willing to lend time and money to friends in need.

However, behind closed doors, narcissists reveal their inability to emotionally attune to a partner’s financial needs. Once married, money becomes a tool for manipulation, micromanaging the household budget while scrutinizing a partner’s reasonable requests.

3. Money as Means of Control

Since narcissists feel entitled to special treatment, they use money to ensure dominance in relationships. They may make important financial decisions without consultation, deliberately keeping bank accounts separate.

College funds, investments, and retirement savings become ways to maintain power over the partner through economic dependency. Instead of mutual collaboration, the narcissist creates a dictatorship around financial matters.

4. Vindictive Financial Tactics

Retaliation is central to the narcissist’s playbook. If their authority goes unchecked or their ego gets bruised, they retaliate with money-related punishment. A narcissistic partner may torch a spouse’s credit score out of vengeance.

They will nickel-and-dime reasonable household expenses while justifying their unnecessary luxuries. If separation occurs, the law-breaking manipulation escalates: hiding money in secret accounts, refusing to pay court-ordered support, and dragging out divorce proceedings seemingly without end.

5. Double Standards Around Spending

While keeping strict tabs on their partner’s spending, narcissists feel entitled to special treatment regarding their expenses. They rationalize impromptu shopping sprees, cosmetic procedures, and lavish trips, yet criticize a partner’s minor indulgences.

Their twisted logic suggests that their needs inherently carry more weight. Narcissists expect others to finance their upper-class lifestyle while they nickel-and-dime their partner’s necessities. Confronting the narcissist about money typically intensifies manipulation or retaliation.

How Narcissists Use Money for Abuse

Narcissists wield money as a weapon to inflict harm with little accountability. Financial abuse involves controlling a victim’s ability to acquire, spend, manage, or track monetary assets.

This restricts access to financial independence so the narcissist can impose their will. Tactics may include coercion, exploitation, sabotage, and manipulation around money matters.

Narcissists assert unilateral control over assets earned jointly. They depict reasonable household spending as frivolous or wasteful unless directed toward their comfort.

The narcissist sets an unrealistic budget that deprives family members of essentials while preserving their indulgences. Victims are forced to account for minor purchases while the narcissist conceals expenditures.

Requests for financial transparency are met with diversionary tactics: gaslighting, projection of blame, and indignant offense at the implied distrust after years of financial infidelity.

Instead, the demand for accountability only intensifies secrecy and pettiness: the slow draining of joint accounts, hidden credit card statements, and new levels of financial trickery.

Seeking external work becomes another site of sabotage. The narcissist may actively undermine the victim’s career efforts through chronic criticism, sowing self-doubt, or sabotaging preparation for interviews.

Once successful, the narcissist uses new income as justification to escape their financial responsibilities. Court orders cannot contain their financial abuses; they view penalties as nominal fees for continued syndication of fraud.

Financial abuse both enhances the narcissist’s power and provides a narcissistic supply—the obsession over others’ admiration, validation and resources permeates all dimensions of life.

Recognize that money matters provide no path for ethical persuasion of the narcissist; set boundaries without expecting empathy or fairness. Instead, document abuses, seek legal and emotional support, maintain financial independence, and disengage.

Protecting Against Narcissist Spending Habits

When confronted with the reality of narcissistic financial misconduct, one’s first instinct may be to convince the narcissist of the unreasonableness of their actions.

However, narcissists lack the empathy and accountability necessary to change entrenched behaviors without intensive therapy. Efforts to persuade or bargain typically escalate narcissistic rage or retaliation.

Instead, address narcissistic spending habits through boundaries, documentation, and evaluation of the relationship’s costs.

Recognize that narcissists perpetually view themselves as exceptions to universal rules and norms. Develop financial transparency practices, set limits, and find neutral supports rather than expecting internal transformation.

Strategies include:

With vigilance, education, and external support, individual victims can minimize damage from toxic narcissistic money habits. While the narcissist may escalate manipulative tactics initially, consistent response reduces the facade of control and provides an opportunity for future accountability.

Communicating Financial Boundaries

Communicating boundaries to a narcissistic partner prone to financial exploitation requires strategic delivery and unflinching follow-through. Calmly discuss unacceptable behaviors and concrete consequences, informing any necessary third parties.

Prepare emotionally for manipulation disguised as remorse. Seek counsel from financial experts; therapy aids in managing resultant stress.

Guidelines include:

While communicating financial boundaries, anticipate manipulative efforts to regain the upper hand: gaslighting, temporary compliance, retaliation, and charming reinvention.

Establish reality through documentation, alliances, and behavioral consistency. Prioritize self-protection through accountability systems without expecting internal change. Create financial security independent of the narcissist’s turbulence.

Strategies to Protect Against Narcissistic Spending Habits

Implementing consistent financial boundaries protects against narcissistic money manipulation rooted in a sense of entitlement, victimhood, and rage. Tactics that impose accountability while reinforcing personal empowerment reduce narcissistic control.

Recommended protective strategies include:

Above all, recognize that protecting finances from narcissistic abuse requires ongoing discernment and initiative. The narcissist perceives boundaries as an attack on their entitlement. Expect tests of self-determination. Fortunately, clarity of purpose with consistency transcends even malignant resistance.

Final Takeaway

Narcissists wield money as a weapon, leveraging secrecy, manipulation, and retaliation to gain power. Their harmful financial patterns – deceit, exploitation, fraud – permeate the foundations of intimacy. Yet financial freedom remains possible through discerning narcissistic tactics plus consistent boundary enforcement.

Core strategies for protection include pursuing financial transparency, documenting inequities, and establishing trusted alliances for feedback. Never relinquish all personal assets or income streams. Prepare for turbulence when implementing boundaries; narcissistic pushback escalates before accountability emerges.

With vigilance and support, identify dealbreaker behaviors that signal necessary withdrawal. Set boundaries around financial control and mismanagement calibrated to follow-through capability. Communicate directly, enforce consistently, and uphold through storms of manipulation.

The journey to financial freedom requires detangling from narcissistic money knots through internal authority and external reinforcement. Perceive the narcissist’s inflated entitlement without absorbing distorted perspectives.

Establish reality through action, not argument. Limit engagement around money matters, instead building impenetrable systems for flourishing. Secure finances represent the first step toward a liberated future.